ESG: Thematic or True Conviction?

11.04.2024

I'll confess, I am a big fan of Larry Fink. His acumen is something I admire; the man is, quite simply, brilliant. A few days back, I tuned into Bloomberg's 'Wall Street Week,' eager to hear him discuss his latest annual letter to investors. And true to form, Larry did not disappoint.

When I later asked GPT to summarize the letter, it gave me: “Larry Fink's 2024 Annual Chairman's Letter to Investors emphasizes the importance of investing in capital markets for retirement security, inspired by his parents' financial success, and outlines BlackRock's commitment to help people achieve financial well-being through innovative investment solutions.”

Ah, retirement – a topic as old as time, yet always pertinent. But let's not get sidetracked here. The interesting fact about the summary is what GPT, in all its algorithmic wisdom, no longer mentions: ESG.

Since 2012, ESG has been BlackRock's Trojan horse, a catalyst for its growth. But just as the wooden horse of legend, it seems to have served its purpose. Critics and aficionados alike debate whether ESG is only a thematic play or true conviction, i.e., a fundamental aspect of due diligence. My take, which I present in book chapters 13 and 14 of “Investing for Better,” is that it's a bit of both, with its relevance ebbing and flowing with the tides of time.

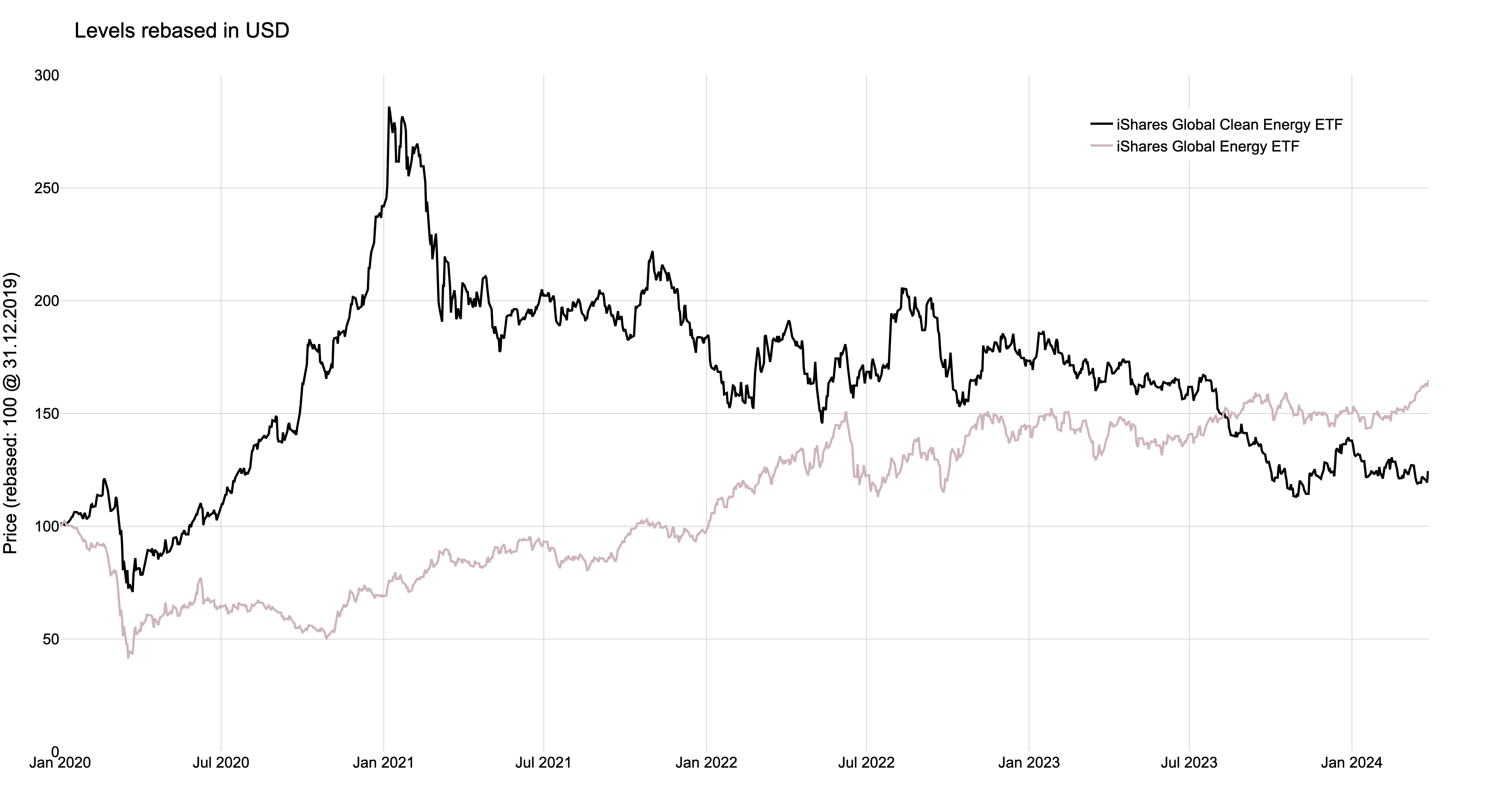

Currently, ESG appears to be showing its thematic hat, as evidenced by the price dynamics of traditional versus clean energy stocks. Consider the graph below, a tale of two iShares ETFs, illustrating this dichotomy. Thematic investors have felt the sting of a narrative that surged in the run-up to Biden's Infrastructure Act, in the wake of COVID-19, and regulatory shifts like the SFDR in Europe, which channeled capital into clean energy – the beating heart of ESG.

But as the saying goes: what goes up, must come down. By 2021, the music stopped, overvaluation reared its ugly head, and those riding the wave of “going clean” faced negative returns. Prices have since adjusted, granting traditional energy stocks the higher ground.

Many theories aim to explain this divergence. Some argue that renewables like wind and solar lack the reliability to power our data-hungry AI centers, which crave a stable energy diet. But fundamentally, energy is fungible – can we really label electrons or molecules as “good” or “bad”? Market forces, not moral tags, dictate the ebb and flow of stock prices, especially within thematic investing spheres.

Could it be that Larry Fink has shifted his stance, migrating from the camp of ESG purists to a thematic approach? It's a bold hypothesis, but then again, adaptation and evolution have always been at the heart of BlackRock's – and Larry's – philosophy and strength.